How Tourism Brands Can Succeed in China’s Digital Market: Insights, Strategies, and Trends

Introduction: Navigating China’s Digital Travel Ecosystem

China represents one of the most lucrative yet complex markets for global tourism brands. With over 1 billion mobile internet users and a digital ecosystem completely distinct from the West, traditional marketing strategies on Facebook, Instagram, or Google rarely translate effectively.

In China, understanding people matters more than chasing clicks. Success demands localized storytelling, cultural empathy, and data-driven digital innovation across platforms like WeChat, Douyin (TikTok China), Xiaohongshu, Weibo, Ctrip, and Mafengwo..

“Marketing in China isn’t just about translating content; it’s about translating culture.”

Key Digital Marketing Strategies for International Tourism Brands

Based on research and proven brand case studies, successful market entry in China’s travel sector rests on seven strategic pillars.

- Break Down Data Silos

Integrate cross-platform marketing data—WeChat Ads, Xiaohongshu posts, OTA searches—through unified Data Management Platforms (DMPs) to enable precise cross-channel retargeting. - Establish Trustworthy Metrics

Define standardized metrics—impressions, engagement, and conversions—across platforms to ensure reliable ROI evaluation. - Master China’s Platform Ecosystem:

- Xiaohongshu (RED)

- Role: Awareness & lifestyle inspiration

- Marketing Strategy: Partner with KOLs; use immersive storytelling to position destinations or brands as aspirational lifestyle choices

- Douyin

- Role: Conversion & engagement

- Marketing Strategy: Use short videos, interactive campaigns, live streaming bookings

- WeChat

- Role: Loyalty & retention

- Marketing Strategy: Develop mini-programs, CRM, travel service automation

- Ctrip / Mafengwo

- Role: Research & planning

- Marketing Strategy: Launch UGC travel notes, destination pages, thematic campaigns

- Dianping

- Role: On-ground decision making

- Marketing Strategy: Co-branded restaurant promotions, check-in challenges, and local reviews

- Xiaohongshu (RED)

- Create Cross-Device, Personalized Experiences

Chinese travelers plan trips seamlessly across devices — watching Douyin videos during commutes, browsing Ctrip at lunch, and saving itineraries on WeChat.

Brands that synchronize websites, mini-programs, and mobile apps deliver cohesive loyalty programs and real-time personalization, boosting conversion rates. - Optimize Mobile Advertising Performance

Leverage AI-driven ad targeting, vertical video formats, and interactive storytelling to engage users on the devices where decisions are made. - Track Exposure and Performance

Performance goes beyond clicks — every ad impression should be measurable. In China, social buzz and consumer sentiment carry significant weight. Build real-time dashboards to monitor, analyze, and continuously optimize campaigns and budget allocation. - Adopt Programmatic and AI-Driven Ad Buying

Use programmatic advertising to increase efficiency, and AI predictive modeling to forecast travel intent, improving both ROI and campaign agility.

From KOLs to KOCs: The Shift to Authentic Influence

Mega KOLs once dominated travel marketing. Today, KOCs (Key Opinion Consumers) — real travelers, lifestyle enthusiasts, and photographers — are driving trust and engagement.

- Instead of scripted endorsements, brands now invite them to join “experience creator programs”, sharing authentic travel diaries or short videos that resonate with niche audiences.

- Micro-community seeding is also on the rise: small WeChat groups or Xiaohongshu clusters share genuine trip insights, often incentivized with loyalty points or vouchers.

- Platform-Specific Influence: Ctrip, Mafengwo & Dianping

- Ctrip (Trip.com)

Evolving from a booking site into a content community via Trip Moments, Ctrip encourages UGC and photo sharing. Brands can collaborate on destination pages or themed campaigns to inspire travel planning.

- Mafengwo

Still China’s most influential UGC-based travel community, Mafengwo thrives on real traveler stories and Q&A..

- Dianping

Known as the “decision battlefield” for travelers, Dianping excels in on-ground activations such as co-branded restaurant experiences and in-store digital challenges..

Case Studies: How Global Brands Localize in China

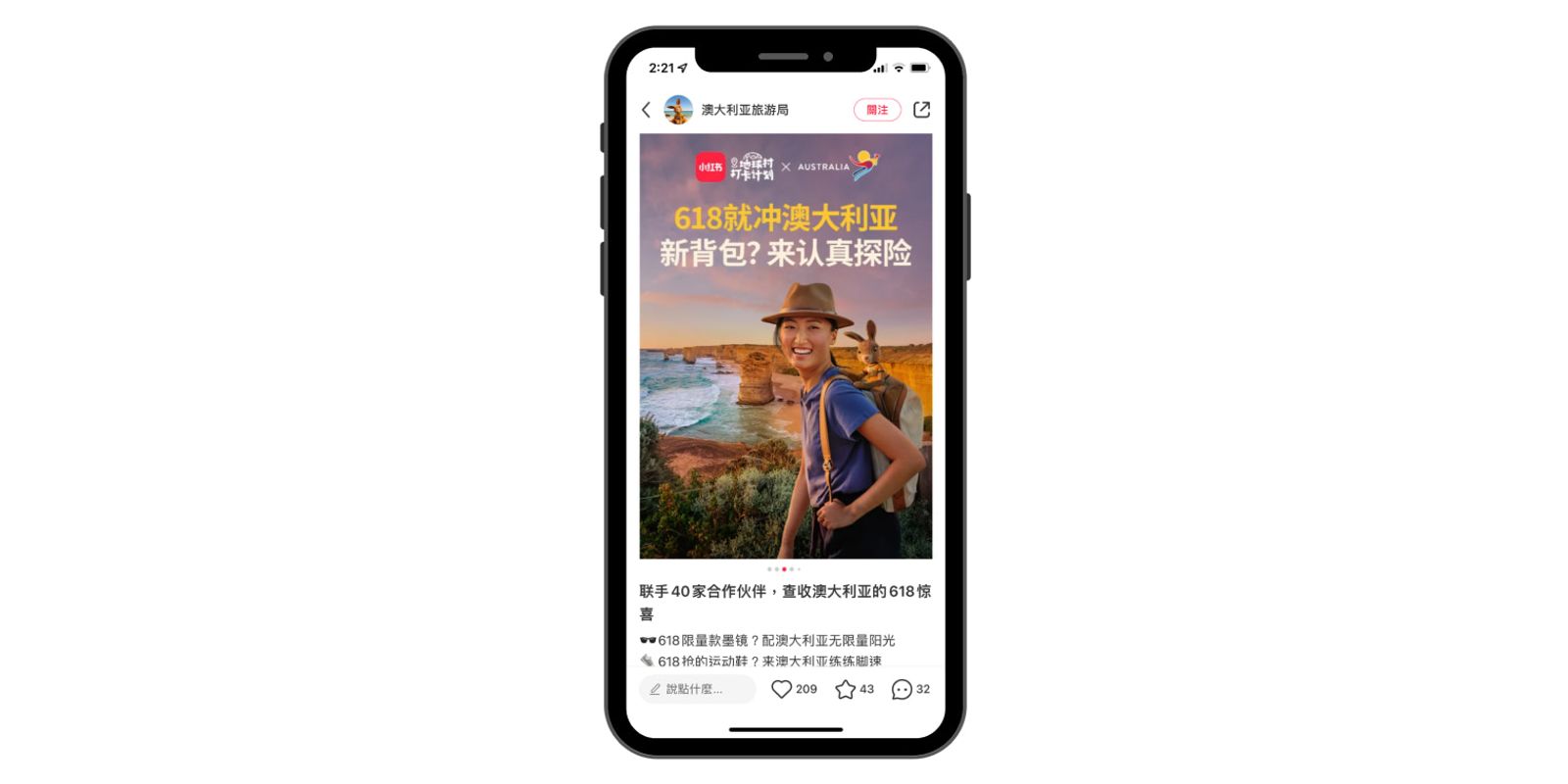

Tourism Australia: Xiaohongshu Lifestyle Marketing

Tourism Australia collaborated with Xiaohongshu’s “Global Village Check-in Project” during the 618 Shopping Festival.

With over 40 travel brand partners, the “Go for Australia” campaign promoted exclusive travel offers, inspiring Chinese travelers to discover their own “live moments.”

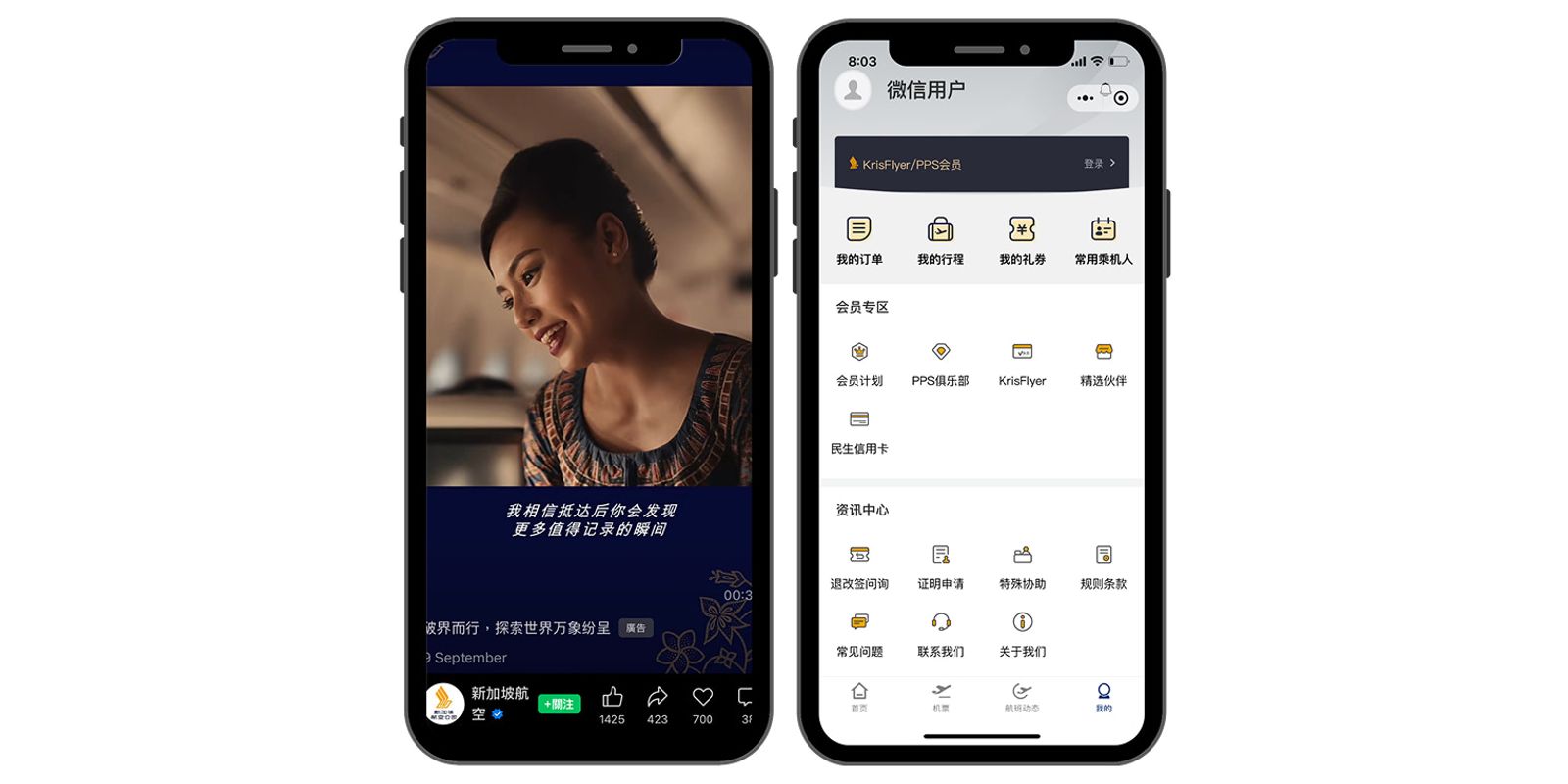

Singapore Airlines: Video Content for Premium Branding

Singapore Airlines uses WeChat Video Channels to showcase 60-second in-flight experiences, highlighting premium services and loyalty perks. This strengthens brand affinity among high-value Chinese travelers.

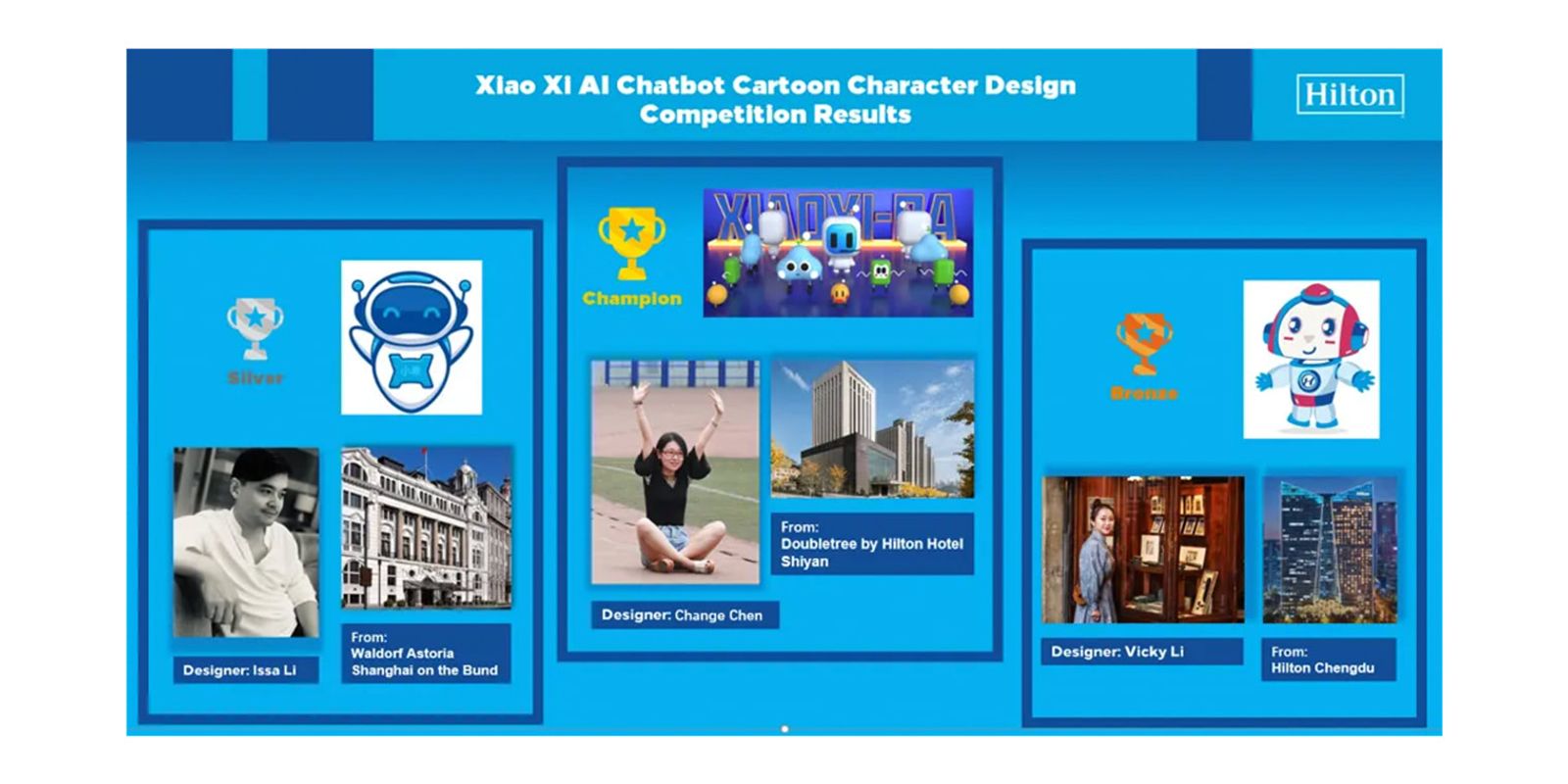

Hilton: AI-Powered Guest Engagement

As it pursues its digital innovation strategy, Hilton has remained dedicated to creating exceptional online experiences for guests. Hilton’s AI chatbot “Xiao Xi”, available via its WeChat Mini Program, provides real-time travel advice and loyalty program details.

Since launch, Xiao Xi has handled over 50,000 inquiries with a 94% satisfaction rate, showcasing how AI-powered personalization enhances guest experience.

Image Source: Hilton

Tourism Consumption Trends in China: Global Tourism Retail Recovery

According to the China Duty-Free Consumption (CDF) White Paper 2024–2025, global travel retail reached US$74.1 billion in 2024, up 3% year-over-year, recovering to 85.8% of pre-pandemic levels. China is leading the rebound, driven by policy support — such as Hainan duty-free zones and city duty-free stores — and growing consumer confidence. This has shifted the market focus from “recovery” to “reinvention.” Key growth drivers include the resumption of international travel, supportive government policies, and accelerated digital transformation.

Emerging Consumer Segments: From Scale to Precision

China’s tourism retail consumers can be divided into key groups:

- Luxury Lifestyle Seekers – Experience-first travelers with high spending power

- Gen Z Explorers – Spontaneous, novelty-driven, short-trip travelers

- Silver Wellness Travelers – Seniors seeking comfort and health experiences

- Digital Natives – Tech-savvy travelers valuing convenience and personalization

Personalization and experience-first consumption now define the new travel economy. Brands must shift from mass marketing to targeted, insight-driven strategies for each consumer segment.

Three Emerging Trends

- Guochao (National Trend) Rise – Domestic brands achieve premium positioning through innovation and cross-sector collaboration.

- Experience Economy – Immersive retail, interactive installations, and lifestyle content transform shopping into a cultural experience.

- Omnichannel Integration – AR/VR, online exclusives, and offline activations create seamless “click-to-visit” experiences.

Future Outlook: Next Steps for Tourism Digital Marketing in China

- AI-Driven Marketing & Personalization

From AI-generated itineraries to predictive analytics, artificial intelligence is redefining how brands engage travelers and optimize customer journeys. - Cultural Co-Creation

Destinations are partnering with local creators and e-commerce platforms to build cultural resonance.

Example: New Zealand’s Hui Māori Collective joined Tmall Global, offering indigenous-branded products and authentic storytelling to Chinese consumers. - Payment as Marketing

Payments are no longer just transactions — they’re experiences. Integrated campaigns using WeChat Pay and Alipay, such as “Scan & Win” promotions, transform payments into engagement opportunities. Some brands go further by embedding QR-based sweepstakes or loyalty programs directly into the payment process.

Example: In Japan, full integration of Alipay, WeChat Pay, UnionPay, and PayPay allows Chinese tourists to “pay like locals”, enhancing convenience while driving brand interaction.

4. From Golden Week Campaigns to Year-Round Engagement

China’s National Day holiday is massive, but the most effective brands go beyond seasonal peaks. By connecting WeChat mini-programs, loyalty CRM, and post-trip re-engagement, brands should adopt full-cycle strategies: pre-trip inspiration → during-trip support → post-trip retention, rather than focusing solely on peak travel periods.

Conclusion: Digital Marketing — Bridge & Challenge

"China’s National Day is the world’s Golden Week."

True success in China’s digital travel market isn’t about ad spend — it’s about understanding digital behavior, cultural nuance, and mobile-first habits.

Brands that blend data insights, authentic storytelling, and seamless digital experiences will define the next era of tourism marketing in China.

China Digital Dynamics helps tourism brands thrive by crafting culturally resonant stories, actionable insights, and mobile-first campaigns — bridging the gap between global ambition and China’s unique digital reality.