Cosmetics in China 2025: Breaking Into the World’s Fastest-Evolving Beauty Market

China’s Beauty Market: Fast Growth, Fierce Differentiation

China’s beauty market is a paradox — both fiercely competitive and full of opportunity. Valued at nearly USD 78 billion by 2025 (China Briefing), it continues to outpace global growth. But foreign brands often underestimate its complexity — not because of its size, but because of how quickly consumer tastes, digital habits, and cultural codes evolve.

Winning here requires more than Chinese packaging. Success means mastering cultural relevance, social commerce ecosystems, and tech-powered storytelling.

China’s post-pandemic beauty recovery has been driven by Gen Z and Gen Alpha, who value individuality, wellness, and clean beauty as much as prestige. According to McKinsey (2024), Gen Z beauty spending in China has grown by 40% since 2021, fueled by premium skincare, niche fragrances, and functional cosmetics like SPF hybrids.

While global giants such as L’Oréal, Estée Lauder, and Shiseido still dominate the luxury segment, domestic challengers like Perfect Diary, Florasis (Hua Xizi), and Judydoll are redefining beauty with cultural storytelling and digital fluency — speaking to Chinese identity, not just Chinese consumers.

Knowing Your Audience: Who Buys Beauty in China

Gen Z: The Digital Curators

Born between 1995–2010, Gen Z accounts for nearly one-quarter of China’s beauty spend. They use beauty for self-expression, not perfection. Their purchases are guided by social validation, influencer credibility, and product transparency.

They live on Douyin, Xiaohongshu (RED), and Bilibili, following tutorials, reviews, and livestreams. For them, beauty brands are community voices — not advertisers.

Millennials: Quality and Lifestyle Seekers

Millennials in their 30s and 40s bridge aspiration with practicality. They prioritize efficacy, brand heritage, and sustainability, often purchasing through WeChat or Tmall flagship stores for trusted recommendations.

Men’s Beauty: The Quiet Revolution

China’s men’s grooming market exceeded ¥20 billion (≈ USD 2.8 billion) in 2024 (iResearch). Male consumers are embracing skincare and makeup, inspired by public figures like Wang Yibo. The modern Chinese man isn’t hiding his foundation — he’s livestreaming it.

The Platforms That Define Beauty in China

Douyin (TikTok China): Where Discovery Drives Sales

With over 750 million daily active users, Douyin is where beauty trends go viral. Storytelling beats status — emotional content converts.

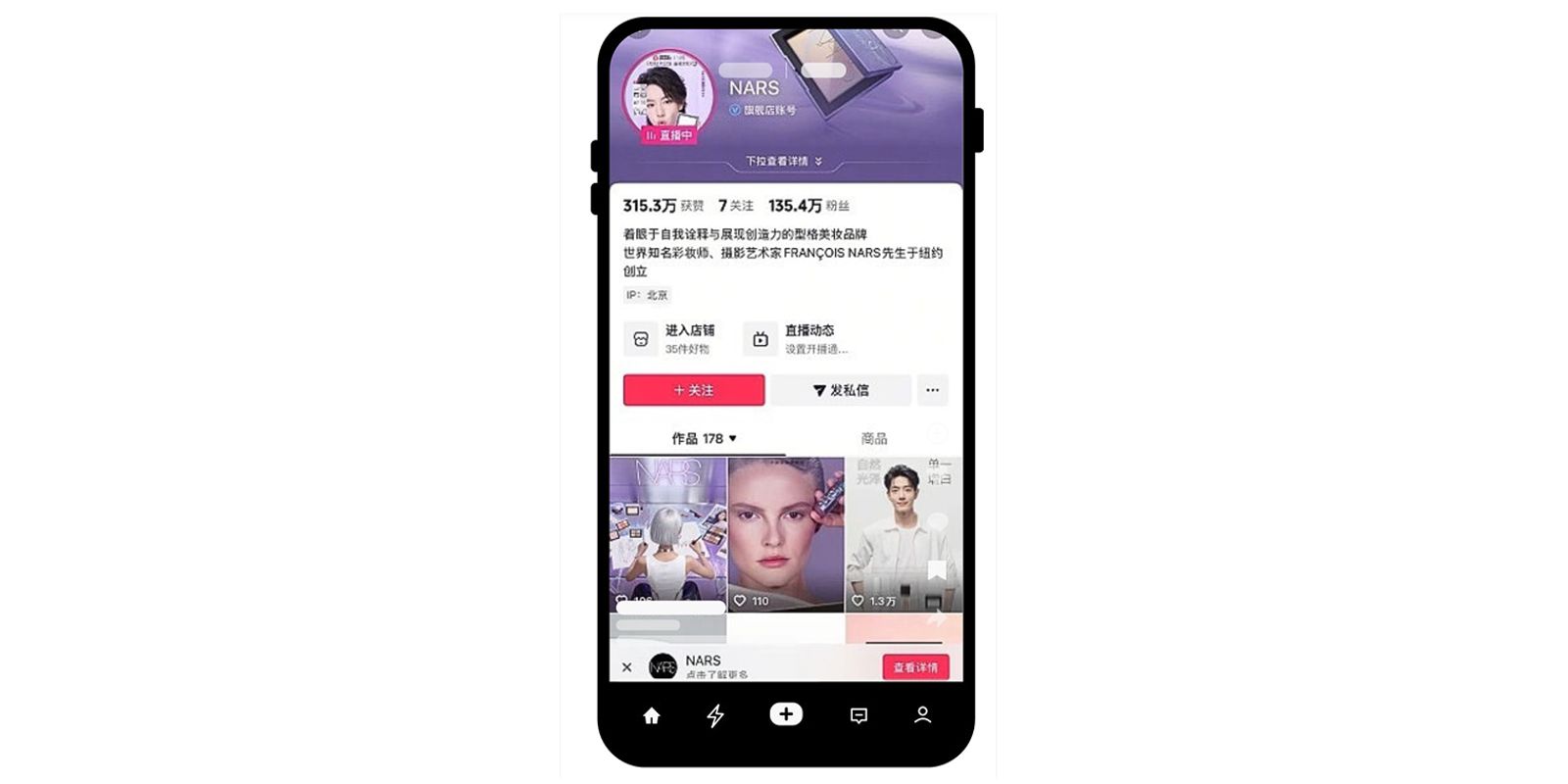

For example, NARS China used hashtag challenges and influencer live tests to promote its foundation line, generating 100 million views and record-breaking Tmall conversions during the 2024 “618 Festival.”

Xiaohongshu (RED): The Beauty Search Engine

RED is a hybrid of Instagram, Pinterest, and Sephora. Nearly 70% of users engage with skincare or makeup content.

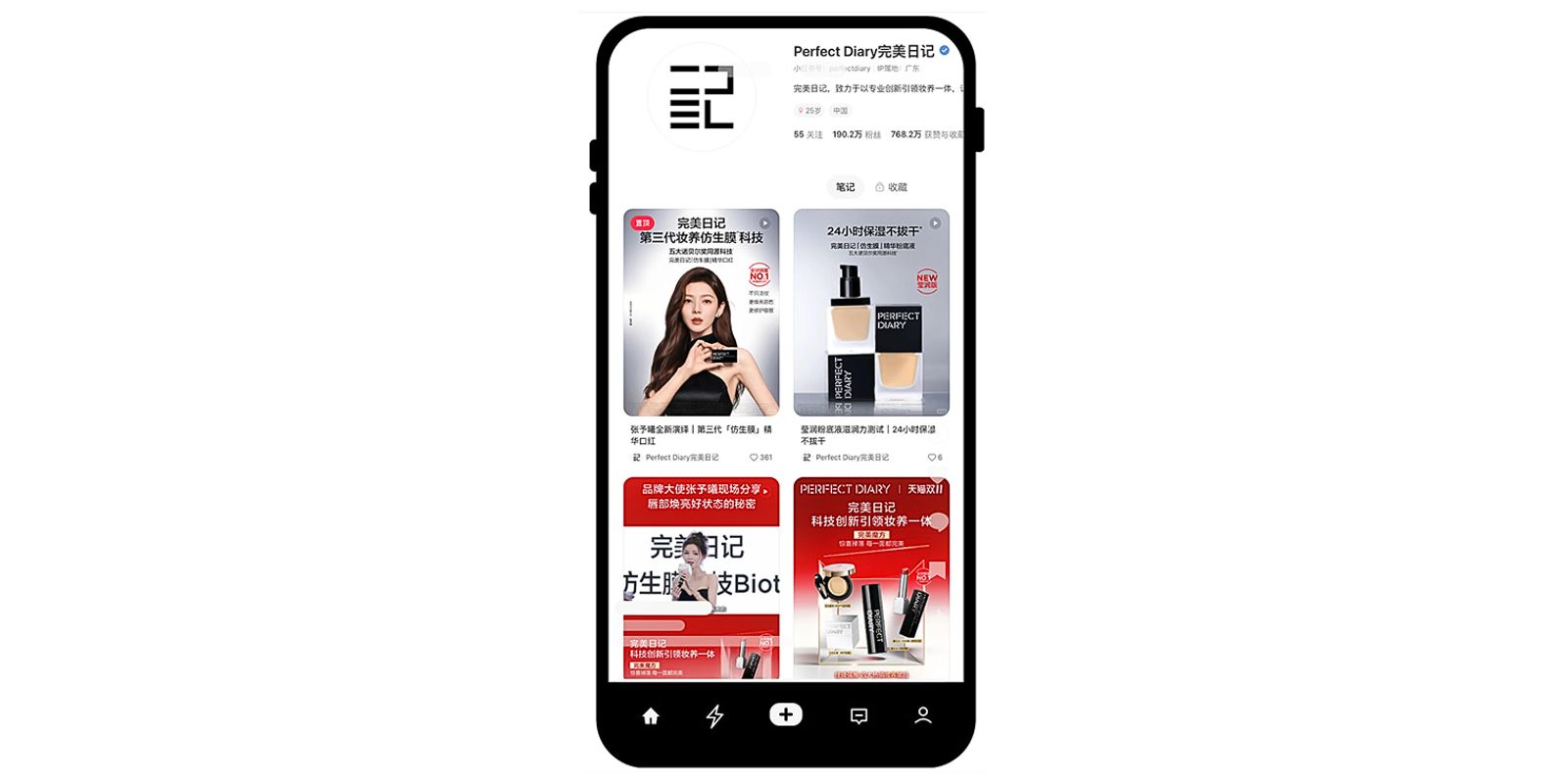

Established in 2017, Perfect Diary has become the NO.1 beauty brand among T-mall young followers of domestic products in 2019. The brand expands its power on Xiaohongshu — inviting users to co-create tutorials, share unfiltered reviews, and vote on packaging. The result: a community, not just a customer base.

WeChat: Relationship and Retention

WeChat is less about discovery and more about nurturing loyalty. Official accounts push exclusive content, CRM programs, and private group sales. Beauty brands use Mini Programs for loyalty systems, booking skin consultations, and virtual try-ons.

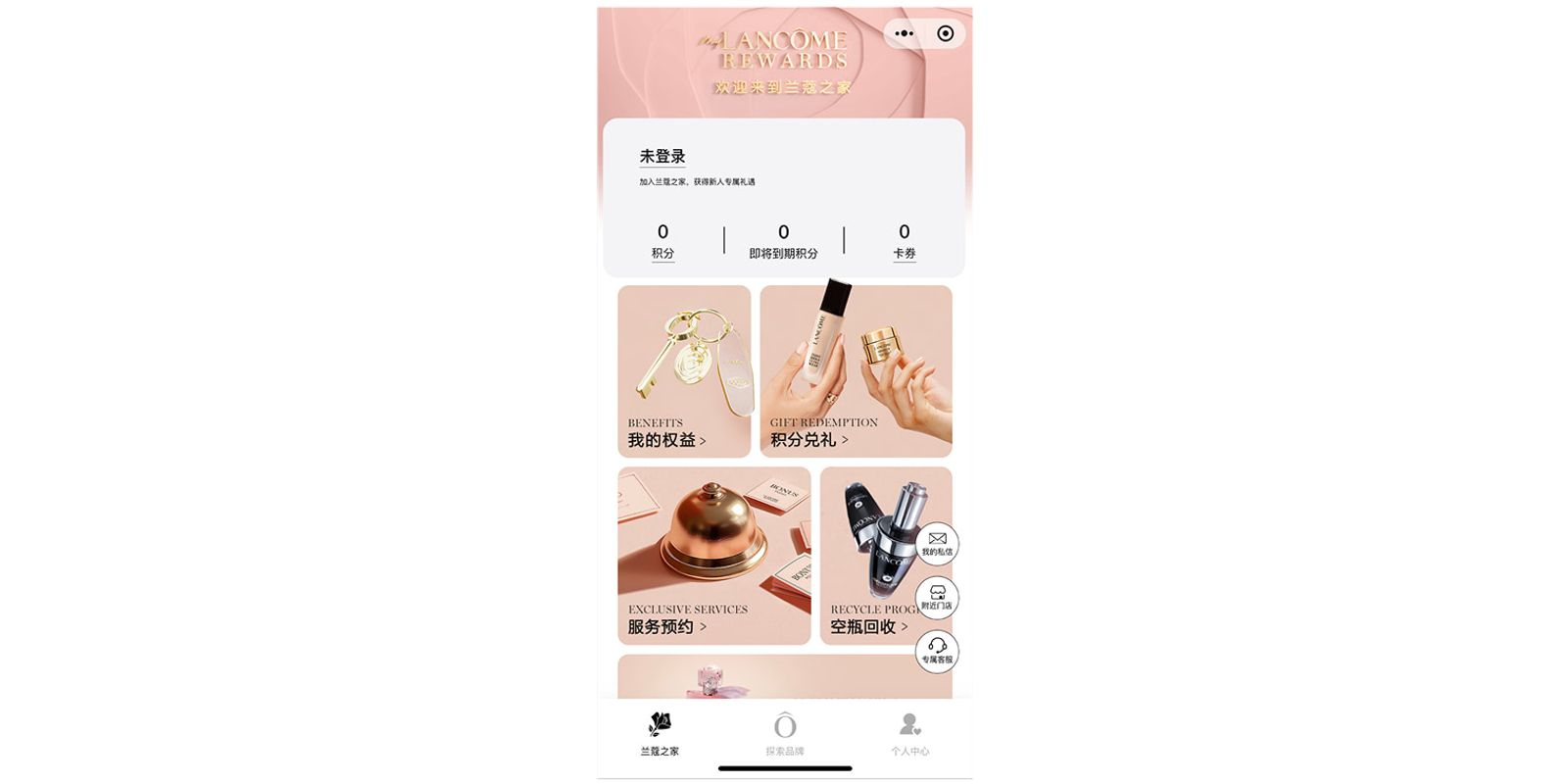

Lancôme China developed a WeChat Mini Program allowing users to make reservation and book exclusive service. The tool helped convert browsing into subscription-style purchases.

Tmall and JD.com: The Transactional Core

These e-commerce giants remain essential for credibility and cross-border logistics. Tmall Global has become the default entry point for foreign beauty brands, offering access to bonded warehouses and localized marketing support.

During 2024’s Double 11 Festival, the beauty category was among the top three in total GMV, with premium skincare accounting for 36% of all sales, per Alibaba’s data.

Crafting a Winning Strategy: From Hype to Habit

Going Local, Not Literal: Reimagining Global Beauty for China

Success in China requires more than Mandarin packaging. It’s about aligning with local beauty ideals and cultural nuance. For example, “whitening” once meant fairness; now it implies “brightening” and “skin clarity.” Western brands that fail to adapt tone often miss the mark.

Fenty Beauty, though initially praised for inclusivity, struggled to localize shade perception and cultural messaging, leading to limited resonance. By contrast, Florasis blends ancient Chinese aesthetics with modern product science — turning traditional motifs into digital storytelling assets.

Influencer Ecosystems: The Power of the KOL and KOC

In China, Key Opinion Leaders (KOLs) like Li Jiaqi (Austin Li) still drive massive traffic, but rising Key Opinion Consumers (KOCs) — micro-influencers with authentic voices — now deliver higher ROI.

When Shiseido’s Drunk Elephant entered China in 2023, it partnered with micro-creators on RED who shared unsponsored “first impressions.” The result: trust before transaction — a key ingredient in today’s beauty marketing.

Livestreaming: Commerce Meets Entertainment

Beauty livestreaming remains a dominant conversion engine. Brands now integrate AI beauty filters, interactive coupons, and gamified giveaways to sustain attention.

L’Oréal Paris collaborated with Douyin’s top creator to launch its “Youth Code” serum. The live session exceeded ¥100 million in sales in a single night, setting a benchmark for brand-influencer synergy.

Yet, smaller brands are also thriving. Indie label Into You built its cult status through “lip mud” demonstrations by mid-tier influencers who favored real, messy swatches over glossy edits.

Trends Reshaping China’s Beauty Industry

Tech-Infused Beauty

AI skin analysis, AR try-on filters, and smart mirrors are moving from novelty to necessity. In June 2025, L’Oréal and NVIDIA announced collaboration to supercharge beauty with next-generation AI.

Clean and Functional Skincare

Chinese consumers are scrutinizing ingredients. “0 additives,” “sensitive-skin safe,” and “medical-grade” claims drive growth in derma-cosmetics. Domestic brand Winona — known for dermatologist-backed formulations — has become a market leader, proving scientific storytelling outperforms superficial glamour.

Cultural Storytelling

Chinese heritage is trending. Brands weave local symbolism — peonies, porcelain, Tang-style packaging — into design and campaigns. Florasis’s viral “Love Lock Lipstick,” inspired by Hangzhou’s West Lake legend, shows how cultural pride translates into commercial success.

Men’s Grooming 2.0

Beyond shaving and skincare, male beauty influencers on Douyin are normalizing foundation, concealer, and scent layering. This “genderless beauty” wave opens an entirely new vertical for international brands bold enough to embrace it.

Sustainability and Ethical Luxury

Younger consumers expect accountability. Refillable packaging, cruelty-free claims, and traceable sourcing are becoming hygiene factors. L’Oréal and Shiseido now emphasize carbon neutrality and local supply chain transparency in their China messaging.

Real Campaigns That Broke Through

Perfect Diary x Discovery Channel: Storytelling Meets Science

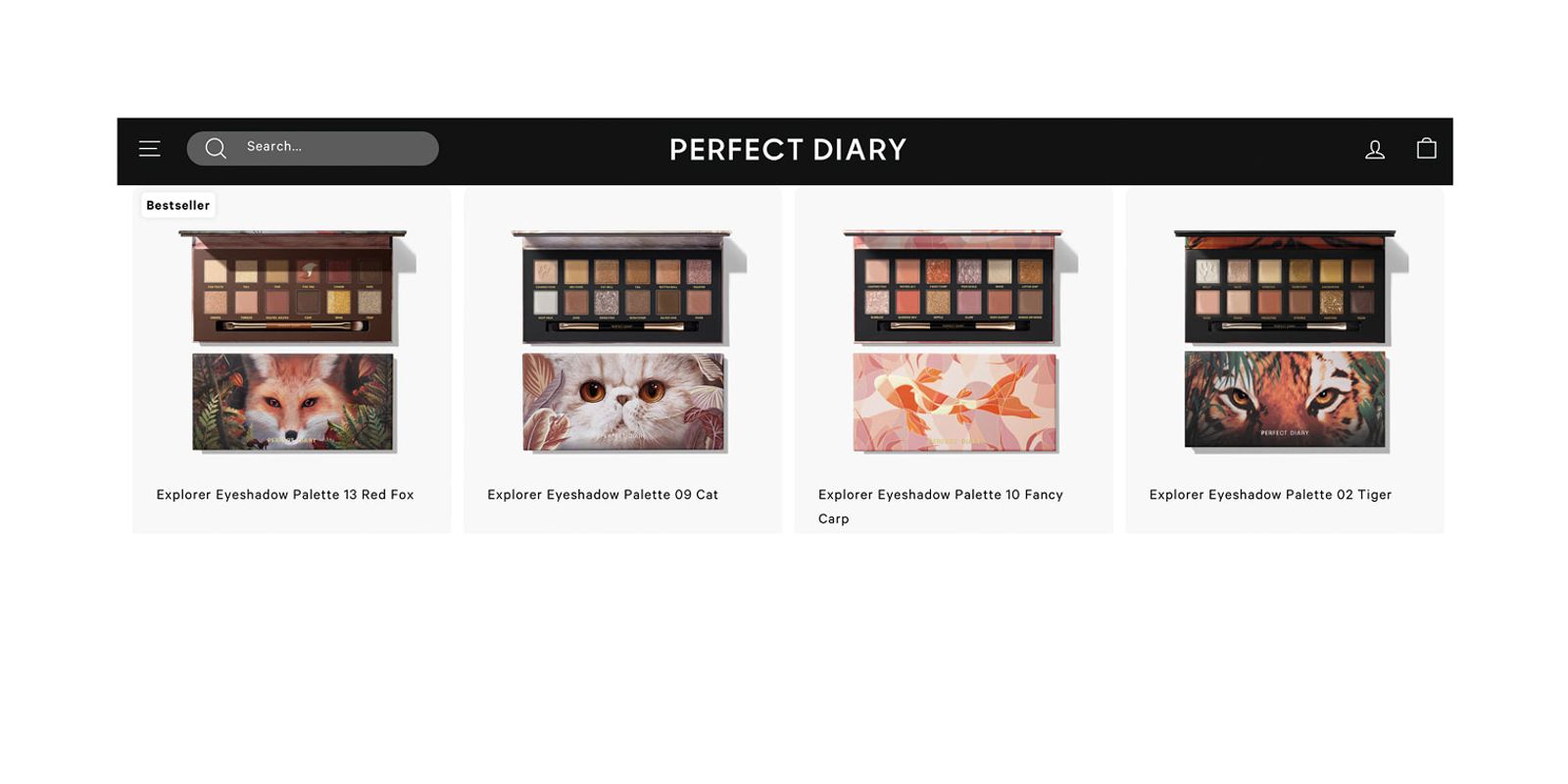

Perfect Diary’s 2020 collaboration with Discovery Channel remains a masterclass in brand-content fusion. The campaign paired makeup collections with wildlife documentaries — leopard-print eyeshadows inspired by nature’s diversity — turning sustainability into art. The brand’s WeChat mini-films amassed over 200 million views and positioned it as a creative Chinese challenger to Western giants.

Lancôme “Happiness Shot” Campaign

To reconnect post-COVID, Lancôme launched “Happiness Shot,” a series of short films and user-generated selfies celebrating inner confidence. Rolled out on Weibo, WeChat, and Douyin, it merged real women’s stories with product benefits — blending emotion and aspiration.

Florasis “Chinese Beauty Renaissance”

Florasis turned cultural storytelling into commercial performance. Its “Peach Blossom Makeup” collection, inspired by traditional paintings, sold out within days on Tmall Global in 2024. The campaign went viral on Xiaohongshu, where users recreated historical looks using the products — proof that heritage + innovation is a winning formula.

L’Oréal “Green Beauty for the Future”

L’Oréal China’s ongoing ESG program uses WeChat Mini Programs to educate users on recyclable packaging and offers loyalty points for bottle returns. It’s a data-driven sustainability narrative that strengthens both brand image and CRM retention.

Entering the Market: What It Takes

Regulatory Readiness

Since China relaxed its animal-testing rules for imported cosmetics in 2021, cross-border e-commerce (CBEC) has become the fastest and most cost-efficient entry route. It lets foreign brands sell via Tmall Global or JD Worldwide without a physical presence — though full registration remains ideal for long-term expansion.

Data-Driven Decisions

Local analytics tools such as QuestMobile, CIVDS, and Alibaba Data Bank help brands understand consumer segments, engagement performance, and content ROI. Without data localization, campaigns risk misalignment with China’s fast-moving consumer sentiment.

Partnering with Local Experts

Success in China rarely happens alone. Working with digital agencies specialized in Chinese platforms, brands can localize storytelling, manage KOL collaborations, and optimize paid media. Local insight is the bridge between brand DNA and Chinese culture.

The Future of Beauty in China: Connection, Culture, and Care

China’s cosmetics landscape is no longer about East versus West, luxury versus mass, or foreign versus local. It’s about connection, culture, and care — understanding what beauty means to the individual and how it reflects broader identity shifts in modern China.

Tomorrow’s winners will not be those who shout the loudest, but those who listen, co-create, and integrate seamlessly into the lives of Chinese consumers.

Beauty in China isn’t a trend — it’s a conversation. The question for global brands is simple: Are you part of it yet?